rhode island income tax withholding

State income tax is an important source of revenue for most states. Effective for wages paid on or after July 1 2001 employers are required to compute the Rhode Island Withholding Tax in accordance with the Percentage Method Schedule or the Withholding Tax Tables.

What Is Local Income Tax Types States With Local Income Tax More

Ad Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. The highest marginal rate applies to taxpayers earning more than 148350 for tax year 2020. WITHHOLDING APPLIED Withholding will be credited to the Nonresident Rhode Island sellerss individual or corporate tax returns which must be filed by the sellers for the year of the sale. Welcome Administering RI state taxes and assisting taxpayers by fostering voluntary compliance through education and.

An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. 2021 Employers Income Tax Withholding Tables PDF file less than 1 mb megabytes. The income tax is progressive tax with rates ranging from 375 up to 599.

Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020. A resident is defined as anyone who is domiciled in the state or who spends.

Employees must require employees submit state Form RI W-4 if hired in 2020 or when making withholding tax changes in 2020. Employers are responsible for withholding state income tax for employees while individuals are responsible for filing state income tax returns and paying tax owed. Withholding and when you must furnish a new Form W-4 see Pub.

If you already have a portal account and need assistance navigating the tax portal please view our Portal User Guide by clicking HERE. If the employee is temporarily working within State A solely due to the COVID-19 State of Emergency the employer should continue to withhold Rhode Island income tax since the employees work is derived from or connected to a Rhode Island source. If you are entitled to a re- fund because the amount paid or credited as estimated tax for the taxable period exceeds your actual tax liability you must file an income tax return to obtain the refund.

REPORTING RHODE ISLAND TAX WITHHELD. The Amount of Rhode Island Tax Withholding Should Be. Apply the following tax rates to annualized taxable wages to determine the annual tax amount.

Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax Only the registration for the permit to make sales at retail including litter fee cigarette license require. Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis. Rhode Island Division of Taxation One Capitol Hill Providence RI 02908.

Rhode Island income tax on a current basis on income other than salaries or wages sub- ject to withholding. WEEKLY - If the employer withholds 600 or more for a calendar month. In Rhode Island there are five possible payment schedules for withholding taxes.

Divide the annual Rhode Island tax withholdings by 26. WHO MUST MAKE ESTIMATED PAYMENTS. 505 Tax Withholding and Estimated Tax.

Your payment schedule ultimately will depend on the average amount you hold from employee wages over time. 147 Resident Individuals Employed. Daily quarter-monthly monthly quarterly and annually.

What you need to know. Due to a recent change in the Rhode Island Income Tax Law the state withholding tax is no longer a percentage of the federal ta x withheld. The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state.

Additionally employers in other states may wish to withhold Rhode Island personal income tax from wages of their Rhode Island employees as a convenience to those employees. The more you withhold the more frequently youll need to make withholding tax payments. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2021pdf UMass employees who reside in Rhode Island use the RI-W4 form to instruct.

Unlike the Federal Income Tax Rhode Islands state income tax does not provide couples filing jointly with expanded income tax brackets. Rhode Islands maximum marginal income tax rate is the 1st highest in the United States ranking directly below Rhode Islands. The supplemental withholding rate for 2020 continues at 599.

Withholding Tax Filing Due Date Calendar 2021 2021 Withholding Tax Filing Due Date Calendar PDF file less than 1. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. You had no federal income tax liability in 2021 and you expect to have no federal income tax liability in 2022.

If such withholding exceeds the actual tax due the balance will be refunded upon filing of a return. Subject to Rhode Island income tax withholding. You may claim exemption from withholding for 2022 if you meet both of the following conditions.

RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than 1 mb megabytes RI-1040NR 2021 Nonresident Individual Income.

Federal Income Tax Deadline In 2022 Smartasset

Check Out How Income Tax Is Calculated On Business Income Abc Of Money

State W 4 Form Detailed Withholding Forms By State Chart

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

How Is Tax Liability Calculated Common Tax Questions Answered

What S Your State S Dividend Income Tax Thinkadvisor

State Income Tax Rates Highest Lowest 2021 Changes

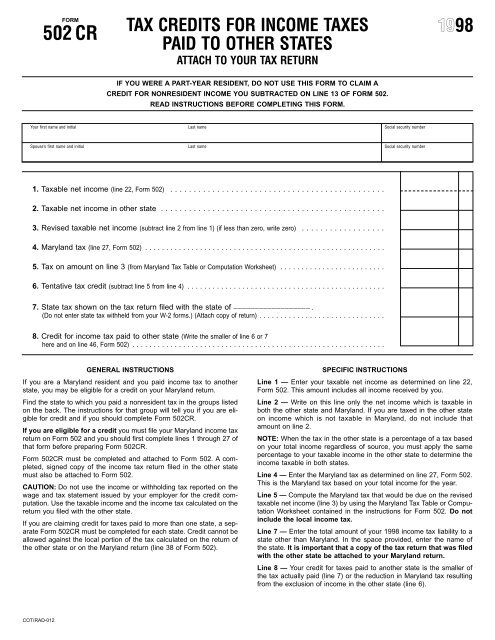

Tax Credits For Income Taxes Paid To Other States

State W 4 Form Detailed Withholding Forms By State Chart

What Are Salary Taxes For Software Engineers In The Usa Quora

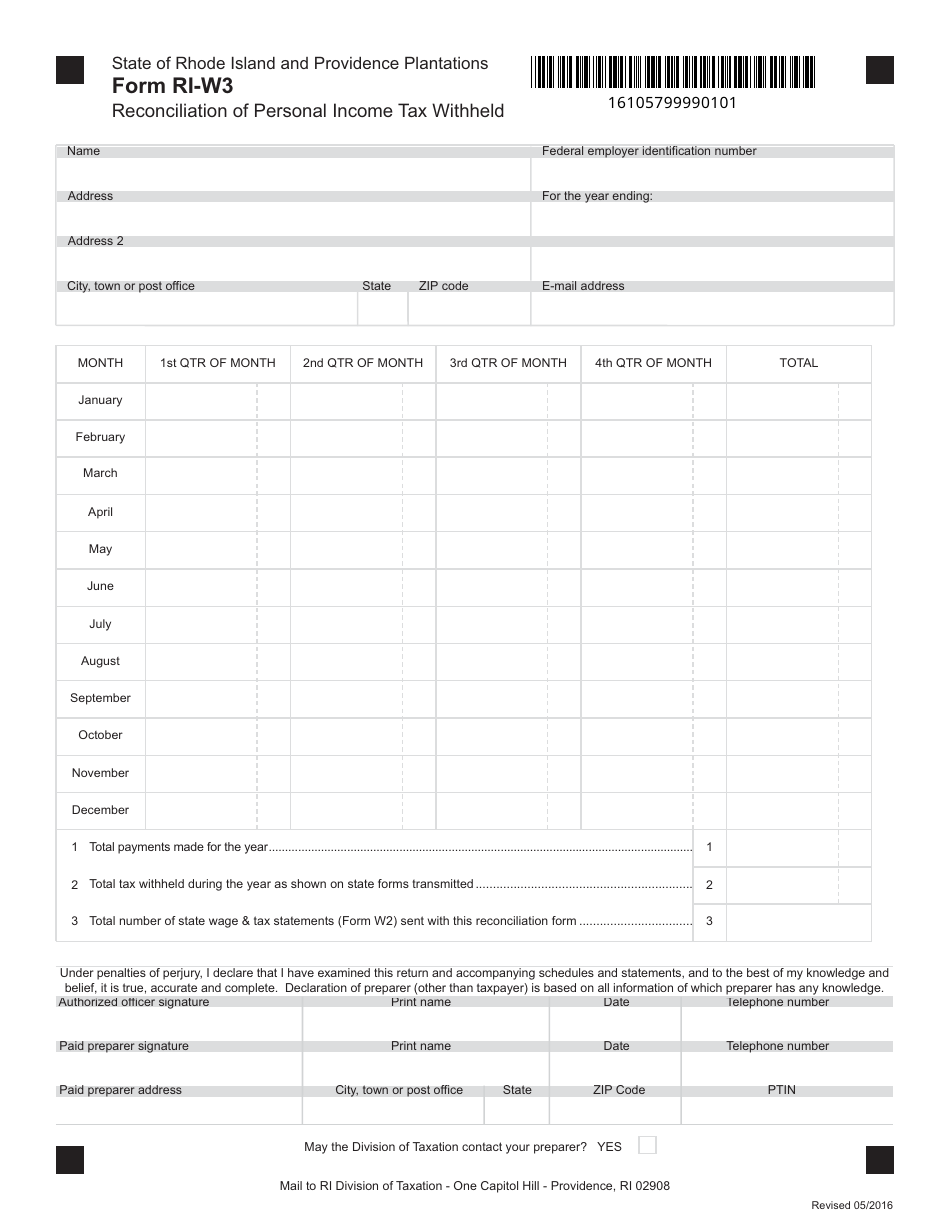

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

What Is Local Income Tax Types States With Local Income Tax More

State Corporate Income Tax Rates And Brackets Tax Foundation

Indiana Income Tax Rate And Brackets 2019

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Is Tax Liability Calculated Common Tax Questions Answered

State Income Tax Withholding Considerations A Better Way To Blog Paymaster